When Does a House Become a Home? - Part 2

We all need a place to live.

A place to grow.

A place to feel safe.

But at what cost?

They told us it was the dream:

Get the mortgage.

Secure the house.

Spend the next 25 years paying it off.

Stability. Success. Safety.

But what happens when the house you spent your life working for…

never truly becomes a home?

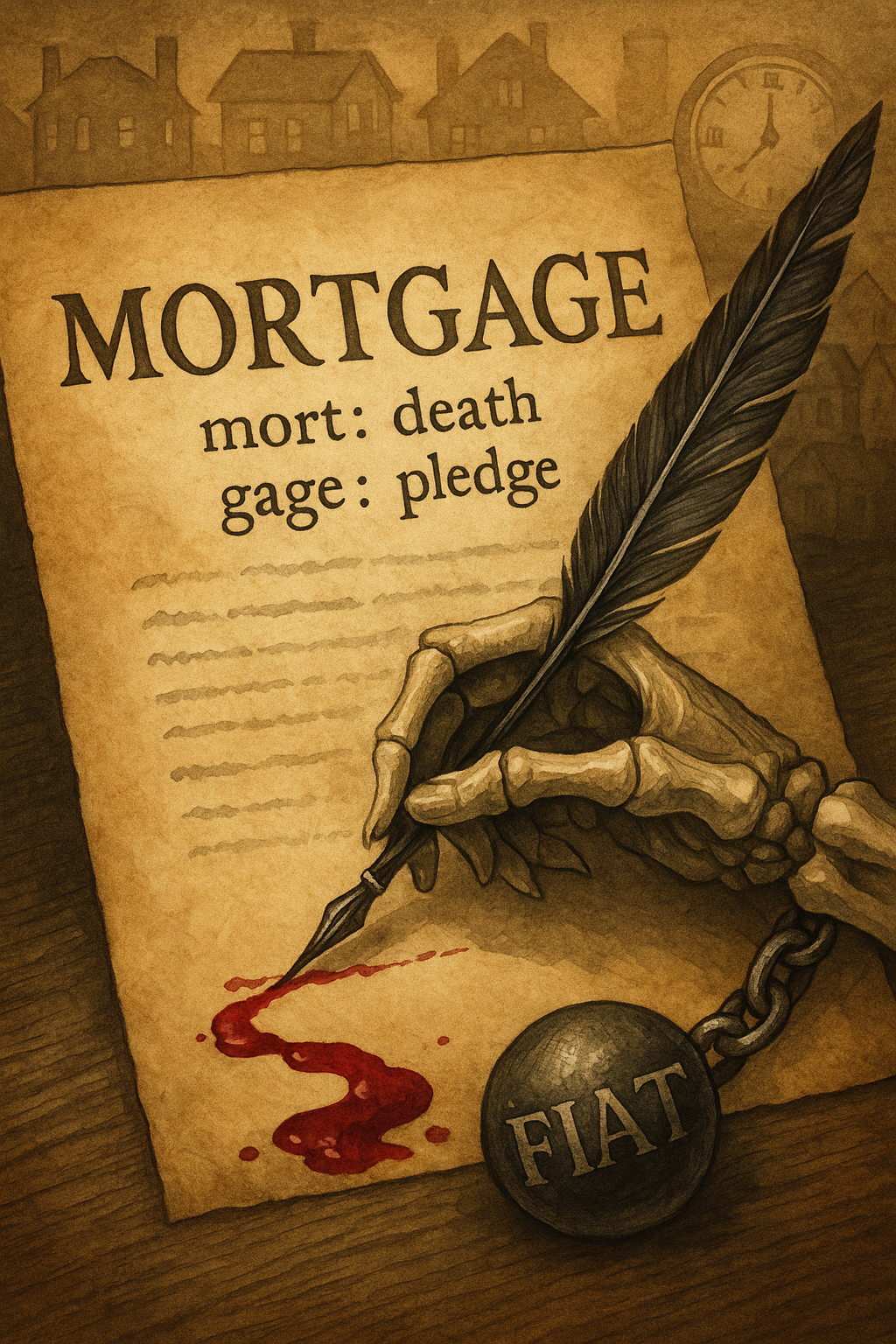

Mortgage — From The Latin Mort, Meaning Death.

The word mortgage comes from the Old French mort gage, literally a death pledge, with mort rooted in Latin, meaning death.

A death pledge.

You pledge your time, your energy, your life force, in exchange for a structure made of bricks.

But ask yourself:

Who are you really working for?

The Down Payment

10%? 20%? Maybe even 40%?

£30,000… £50,000… £100,000+

Do you remember what it took to save that?

The hours. The sacrifice. The uphill grind.

It felt like “ice skating uphill”… but you made it.

You climbed your own hill.

And now?

Do you invest that energy back into yourself, into your dream, your growth?

No.

That’s too risky.

Of course not. Why would you bet on yourself?

You’ve been taught to play it safe.

“Buy a house,” they said.

“It’s the safest investment you’ll ever make.”

You were told:

The house appreciates.

Therefore, you appreciate.

But inflation doesn’t mean appreciation.

It means your money shrinks… while the price of staying still rises.

So when you finally sell the house?

You’re back in cash.

And cash is melting.

You’re not free.

You’re stuck.

20… 25… even 35 years of payments.

The first 10–15? You’re barely touching the principal.

You’re just paying interest, pure economic energy siphoned off the top.

That’s assuming rates stay “low.”

But I remember the 80s and 90s — 14%, 15% interest.

When faith in fiat weakens, rates rise, not to help you…

But to keep the system’s investors from fleeing.

Miss a few payments?

And see who really owns the house.

2008 wasn’t a failure.

It was a feature.

Rates are 4-5% now - But don’t be fooled

Now in 2025 -Compared to the 80s and 90s, household debt is much higher.

So the pressure feels the same, or worse.

Especially when a lot of people have mortgage rates at 1-2% and now having to remortgage soon.

Thats a 20-30% increase in housing cost.

It’s not just the rates.

It’s the weight.

Because when everything costs more, and you owe more.

even a smaller rate can break your back.

Didn’t we see this story already?!?

It’s The Best Mousetrap The World Has Ever Seen.

Lock up your energy.

Call it safety.

Then charge you interest to borrow your freedom back.

That’s not security.

That’s economic servitude.

And this is how it traps you… Mentally.

You work long hours. You’re stressed. Maybe someone at work annoys you. You make a mistake.

Suddenly, the anxiety kicks in:

“I can’t lose this job. I have a mortgage to pay & my money is locked up.”

You commute. Trains. Traffic. Delays. ( it’s nice we can work from home now)

Home at 6–7PM.

Family. Kids. Dinner.

No time for yourself.

Kids in bed by 8PM.

Now you can finally relax…

No. You’re too tired.

Too burnt out.

Too busy to dream.

The weekend comes.

You’re “allowed out.”

Catch up with friends.

Do house maintenance.

Spend time with the kids.

Still no time for yourself.

Your dream fades, You are trapped.

“Put that energy back into yourself… and see how free you become.”

That line from The Arrogance of Power echoes louder now.

Because every mortgage payment hides a lie:

The energy was always yours.

You just forgot.

You traded it… for a key that opens a cage.

Look closely.

The illustration shows what has happened with inflation vs Bitcoin over time. This is for educational purposes only and is not financial advice. All forms of money carry risk — some obvious, some hidden.

In 2014, the average London house cost 2,988 Bitcoin.

In 2025? Almost 5.

What changed?

The house didn’t.

The system did.

“You don’t own the house. The system owns your story.”

I’ve watched people spend 20+ years paying off a house,

Only to reach the finish line… and find the roof collapsing.

After the final mortgage payment had been made, shortly after the roof suddenly collapses. This real life footage captures the debris, and the deeper question. What really makes a house a home?

25+ years of labour.

And the reward?

More debt to fix it.

More stress.

No celebration.

And worst of all…. it happens at retirement.

I was born in 1982. Houses cost £30–48K.

Today? £400–600K+.

Did houses get better?

Or did we just become better slaves?

Some of the best slaves don’t even realise they are slaves.

Quote - Kevin O’Leary - Investor of Shark Tank

“A salary isn’t the problem. Forgetting your dream is.”

That quote hits hard, and it should.

Not because salary work is bad. We’ve all done it. Many still do.

But if you’re on a path that pays you just enough to forget who you are,

to stop building what calls to you,

to silence the voice that says “there’s more for you”…

That’s when it becomes a drug.

If you’re working a job while building your dream — respect.

You are working towards fulfilling your potential.

But if the dream died quietly years ago…

If you’ve stopped betting on yourself entirely…

That pain will catch up!

Let’s Say I’m Wrong.

Let’s say this is the dream.

In the 1970s, one income could support a family.

Today? It takes two.

Sometimes four jobs between two people.

The cost of living rises.

You work more.You see your kids less.

Stress builds.

Time disappears.

Purpose erodes.

Then come the arguments.

Then silence.

Then resentment.

Then separation.

All for the dream of ownership.

That, when you try to sell it, might not even cash you out.

And even if it does… you’re back in fiat.

And the cycle begins again.

No one talks about the real damage.

What happens when you turn away from your dream?

You feel weighed down.

Sad.

Stressed.

Angry.

You blame politicians.

You hate the banks.

Blame the Rich.

It’s the immigrants.

You project your resentment online. You rage. You spiral.

Everyone is to blame.

Fear and cynicism build.

You feel helpless.

Trapped.

Is It really The The financial System’s Fault?

It Starts With Truth.

The system was never broken.

It was engineered to function perfectly.

For those extracting value from your labour.

The Rich?

They aren’t better than you.

They just read the rulebook,

This isn’t failure.

It’s design.

You accepted the cage.

But you forgot…

You can step out.

Do you want to wait another 25 years to find out the truth?

Or…

Do you want to find out what truly excites you?

What your dream is?

What your gifts are?

Your imagination.

Your skill.

Your ability to serve.

The truth is:

You were always the value.

Maybe it’s time…

You bet on the person who knows you better than anyone.

The one who sees your strengths.

Knows your skills.

Knows your limits, but also knows your truth.

That person can’t lie to you.

Because that person is you.

Maybe it’s time…

You bet on yourself.

Because if you aren’t truly happy, what are you afraid of?

You’re already failing.

So when does a house become a home?

It becomes a home….